Operating within the private hire and wider transport industry we are all acknowledgeable of the lengths of criminal activity one shall go to in fraud and defrauding our respective businesses. But who’s responsibility is it to monitor and be aware of such lawless acts?

Well, the answer is all of us!

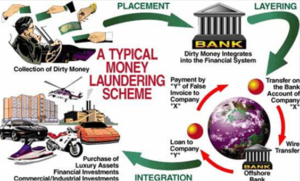

Criminals use diverse methods to launder money which is the proceeds of crimes such as drug trafficking, terrorist activities, and tax evasion. As with other criminal activity, these methods are used to sidestep regulatory and law enforcement measures and to exploit current and emerging channels.

So why is it vitally important that fleets and fleet owners are aware and careful of these channelled methods. This is because the taxi business is one of the main businesses targeted by criminals due to the monetary value of transaction volume that the industry goes through.

For instance, the table below shows the targeted businesses due to being cash incentive businesses:

| Cash intensive businesses

A less visible channel is where criminals are connected to businesses which have a high volume of legitimate cash flow. Examples:

Source of information: https://www.sentrient.com.au/blog/the-6-ways-that-money-is-laundered

|

So, how do we combat such activity? The first thing is to provide our fleet operators and managers with the appropriate training that helps identify signs and advice on what to do if seen such activity and how to protect the business and its associates.

Money laundering costs the UK more than £100 billion pounds a year (Source of information: https://www.nationalcrimeagency.gov.uk/). It is used by criminals and terrorists to move funds and pay for assets. High volumes of criminal money flowing through the UK results in a loss of confidence in UK economy which has far reaching consequences for us all.

(Source of information: Â http://admi.net/cgi-bin/wiki?MoneyLaundering)

Simon York, Director of HMRC’s Fraud Investigation Service, said: “Businesses need to understand that criminal’s prey on weaknesses, so it’s vital they take all steps to protect themselves. The money laundering regulations are key to that, but there’s still a minority of businesses who ignore their legal obligations. These inspections are a wake-up call that if you continue to trade illegally, we will come knocking.” (Source of information: https://www.nationalcrimeagency.gov.uk/news/national-economic-crime-centre-leads-push-to-identify-money-laundering-activity).

What is AML (Anti-Money Laundering)?

Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones. Financial institutions and other regulated entities including the private hire and wider transport industry are required to have a robust program to prevent, detect and report money laundering. At a minimum, an anti-money laundering program should include:

- Written internal policies, procedures, and controls

- A designated AML compliance officer

- On-going employee training

- Independent review to test the program

|

Anti-Money Laundering Program The system designed to assist institutions in their fight against money laundering and terrorist financing. In many jurisdictions, government regulations require financial institutions, including banks, securities dealers, and money services businesses (taxi services and fleet operators), to establish such programs. At a minimum, the anti-money laundering program should include: 1. Written internal policies, procedures, and controls. 2. A designated AML compliance officer. 3. On-going employee training; and 4. Independent review to test the program Source of Information: https://www.acams.org/en/resources/aml-glossary-of-terms#a-9799feca

|

The other question is that who do you suspect? What do they look like? How do you identify the characteristics of such nature? Well, the answer is not as easy. As the statistics below show that most money laundering activity as reported by Marija Lazic of Legal Jobs up to May of 2021 in the UK, that a staggering 30% of acts committed were by individuals under the age of 21.

30% of money mules in the UK are below 21 years old.

One of the most troubling money laundering facts today involves individuals called money mules – people whom criminals use to transfer their illegally obtained wealth on their behalf.

Law enforcers have reported that money mules are getting younger and younger. For instance, 30% of money mules reprimanded in the UK fell below 21 years old.

Source of information: https://legaljobs.io/blog/money-laundering-statistics/

From a private hire fleet perspective Anti Money Laundering (AML) governance to protect the fleet, its drivers, the community, and the country is paramount. Other contributors from a failure to protect internal systems of data protection and GDPR play into this criminal activity.

For instance, identity theft has become one of the top money laundering trends. The number of cases of data breach and identity theft in recent years is alarming (https://legaljobs.io/blog/money-laundering-statistics/)

What’s even more troubling is that criminals use some of the stolen identities for money laundering activities specifically. This relatively new scheme makes the know-your-customer guidelines a crucial part of anti-money laundering initiatives.

Overall, there are numerous ways we can all be found to be exposed and be vulnerable, but taking the necessary steps for firstly gain awareness and embed an active culture of focus and identifying helps everyone affected by this vicious circle.

The Safety as a Standard (SaaS) Member Membership for private hire companies and the wider transport industry and undertaking the Anti Money Laundering (AML) course is a must for all, especially for anyone associated with the industry.

From the clients who are part of the SaaS network have all in high praise acknowledged that the SaaS training programme is detailed and broadens awareness and that the Anti Money Laundering training course is great step to tackle and understand the industry and how to protect the fleet, its drivers and community from criminal activity, which if not addressed will keep on crippling the country, the economy and more importantly the private hire industries future of operations.

Everyone has a choice, and many have chosen SaaS to address this area of concern, but make your choice, be smart and don’t be a victim, but instead be a frontrunner and address the issue.